Ricardo Rola, Head of IT

Itau BBA International

The complete treasury platform

One platform as the single source of truth, Kondor enables treasury front office, back office and risk teams to drive consistency, automation and compliance, and significantly reduce costs while leveraging AI for accelerated outcomes.

Out-of-the-box efficiency – for today and tomorrow

Delivering market standards throughout, yet ready for change, Kondor brings decades of best practice, with a comprehensive readiness that is out of the box, while coupled with the flexibility to adapt to market evolution. Designed with bank ecosystems in mind, Kondor APIs simplify integration with existing internal and external systems, accelerating deployment and time to value.

Global and local expertise

With an expansive international footprint and customer base, our long-standing relationships, deep experience, localized market insights and responsive, on-the-ground teams make us a partner of choice for leading banks – worldwide.

Continuous evolution

With 30+ years in the market, Kondor is a cross-asset, front-to-back-to-risk solution for both containerized and orchestrated deployment – Kubernetes ready, cloud ready and cloud agnostic, to serve a mission-critical role in delivering compliance and market best practices in the treasury space.

Integrated partner solutions

Kondor provides a range of service-oriented applications with APIs to build innovative, business-wide functionalities with minimal infrastructure requirements.

Treasurer

The Co-operative Bank

Front office

Comprehensive reporting, workflows, monitoring and AI-enriched user experience.

Back office

Operational excellence with straight-through processing and event-based management for full, efficient control of post-trade activities.

Risk management

Bringing transparency and visibility to risk management teams, ensuring consistency and coordination with trading activities.

Regulatory compliance

Ensuring you can deliver on your commitments to regulatory frameworks, as they are today and as they evolve tomorrow.

Investing in test automation to reduce upgrade times in an increasingly complex system landscape, for improved system stability and access to the latest Kondor features and updates.

The Digital Banker – Global Bank Tech Awards 2024*

Kondor for Best Treasury Management Solutions Provided by a Vendor

Celent Model Risk Manager Awards 2024

For Military Bank Kondor implementation

IBS intelligence

Best Treasury Implementation, with LP Bank

Best Risk Implementation, with LP Bank

Chartis Pricing and Valuation Systems 2024: Market and Vendor Landscape*

Category Leader:

Why choose us

Multi-asset-class coverage

Trusted globally and relied upon daily by financial institutions – across FX and money markets, futures, interest rates, bonds and derivatives, as well as inflation, equities and commodities

Comprehensive and powerful risk analytics, position management, governance and compliance framework With real-time coverage of credit, market and liquidity risk

Cloud ready

When traditional on-premise needs evolve to the cloud, Kondor is ready to move with you

Increased operational efficiency

Embrace best practices and decades of design, with trusted automation, processes and workflows to achieve efficiencies and performance

Enhanced UI and UX. With Kondor Vision – leverage technology for higher-value end-user engagement with data and decisions

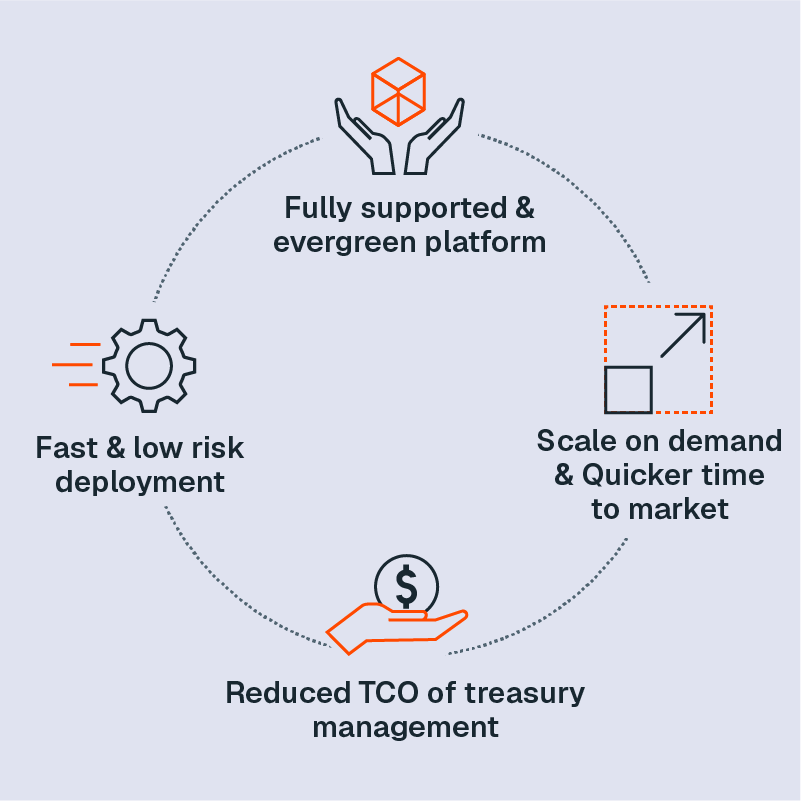

Reduced treasury management total cost of ownership. By an average of 20% to 40% – find out what your number could be

Scalable on demand. Leverage Kondor’s agility-by-design ethos to deliver meaningful impact, aligned to your business’ growing needs

Kondor brings together efficiencies and automation with built-for-purpose design and future-ready agility, to help unlock growth and scale for trading and risk management treasury needs.